Finding and acquiring skilled workers to meet your business needs in today's competitive job market can be challenging. The last thing you need is geographical boundaries getting in the way. This is where an employer-of-record (EOR) provider comes in.

EOR providers act as the legal local employer of international workers, allowing you to hire them without setting up a legal entity in the country they are based.

In addition, you will have more time and resources to focus on your daily business operations and building employee relationships, as the EOR provider becomes responsible for all human resources (HR), compliance, and legal tasks surrounding that employee, including payroll, tax compliance, onboard, and benefits.

As mentioned above, the job market is highly competitive, and gaining access to top talent from other countries will become increasingly essential. UK businesses will be looking to hire talent from Germany, where the workforce is highly qualified in a range of the most competitive fields, including engineering, IT, software development, finance, and business.

Here are some other reasons why UK businesses will benefit from hiring employees from Germany:

This article will explore four things to consider when using an EOR provider to hire employees from Germany.

The German word 'Arbeitnehmerüberlassungsgesetz' (abbreviated to AUG) translates to Temporary Employment Act. If you plan to hire employees from Germany temporarily, it is critical to understand the laws of the AUG and choose a German EOR provider with a valid AUG license issued by the German Federal Employment Agency.

AUG laws regulate the leasing of temporary employees from the EOR provider to your business, aiming to protect temporary workers' rights and ensure fair working conditions. Key provisions of the Temporary Employment Act include:

The minimum wage in Germany, set by the Minimum Wages Act (Mindestlohngesetz), is €12.82 (pre-tax) per hour as of the 1st of January 2025.

German employment laws do not include provisions for overtime pay, so UK businesses should determine and outline any overtime pay in employment contracts when required.

Whilst your EOR provider is responsible for tax compliance when hiring a German employee, it is interesting to know about the country's tax classes as they are very different from what we have in the UK. Germany has six Tax Classes, based on marital and family status:

In addition, if the employee belongs to an official religious institution in Germany, like the Catholic Church, they owe a church tax of 8% or 9% of their monthly income, depending on where they live.

A typical working week in Germany cannot exceed 48 hours, but employees mainly work 40 hours or less (across five or six days). However, employers can request that a German employee work a maximum of 12 hours of overtime per week.

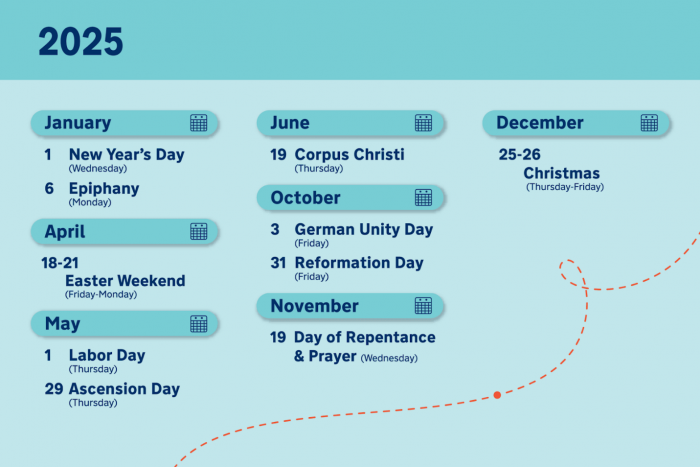

When hiring a German employee, UK businesses must provide leave in accordance with German employment laws. This includes public holidays (which vary from 10 to 12 days, depending on the state) and annual leave entitlements of 20 days for employees on a five-day work week and 25 days for those on a six-day work week.

If you are considering hiring some of the most hard-working and innovative German employees, make sure you do it correctly. Using a German EOR provider will ensure you pay them correctly and on time, whilst minimising the risk of making tax compliance and employee benefits mistakes.

Just remember that EOR providers are used to hire a few employees to work for your UK business whilst remaining in Germany, not to establish a physical presence in the country.

Be the first to post comment!